Temporary Support and Alimony

During the divorce proceedings one spouse may qualify for temporary spousal support. This form of support is sometimes confused with alimony, but the two are significantly different. In short, temporary spousal support is the payment of funds from one spouse to the other, while the divorce proceedings are ongoing. Typically temporary spousal support is for everyday living expenses and, at times, attorney’s fees. The support ceases once the divorce matter concludes. Alimony, if any, occurs as a part of the Decree of Divorce, which is the final agreement between the divorcing spouses. So the of payment of alimony is from one ex-spouse to the other.

Why is Alimony So Complicated?

Divorce matter finances and other marriage particulars affect whether alimony payments are warranted. There are many factors to consider but the most important one is that there are no Nevada statutes that specifically define what makes alimony appropriate or not. And even if it is deemed appropriate, the amount and terms are not defined anywhere. It’s the ultimate divorce crap-shoot. The lack of statutes governing alimony should not be confused with the “Tonopah Formula” which is a set of general guidelines that some, but not all, family court judges may use to consider alimony requests. Guidelines are suggestions, not laws. And even if a judge does use them, each judge may interpret the guidelines differently. This leaves a large legal gray area and is the reason why alimony is so complicated. These complications make having the best divorce attorney for your case facts all the more important.

How Are Alimony Payments Structured?

Also significant is that there is no formula or even guidelines on how much alimony payments should be and for how long. Even the loosely used Tonopah Formula does not offer a payment amount calculation method. Like any other aspect of a divorce case, the structure of alimony payments is defined on a case by case basis. In general there are several payment methods that are routinely used:

- Lump Sum Payment – This is a one-time payment at the conclusion of a divorce matter.

- Monthly Payments – Typically these payments are for a limited time period covering months or years.

- Life-Time Payments – This is the rarest of all alimony awards. Very few divorce matters end up with a negotiated settlement or court ruling for life-time alimony.

Can Alimony Payments Be Terminated?

Experienced divorce attorneys always include a clause in the Decree of Divorce that terminates alimony payments if the receiving party remarries – as long as it is to the benefit of their client. Rather than termination of alimony payments, modifying the payments is more common. There are numerous factors that can validate a request for a change in alimony payments with the most common being a substantial change in financial circumstances of the ex-spouse making the payments.

Are Alimony Payments Taxable?

Since 2019 alimony is no longer income tax deductible for the ex-spouse making the payments. The ex-spouse receiving the payments also does not have to report alimony payments as taxable income. The federal government made this change to increase the total income tax amounts they can legally collect with the thinking that removing tax deductions from the higher income earning ex-spouse will increase overall tax revenues.

The Bottom Line on Alimony

The divorce attorneys for both spouses are largely responsible for whether their client receives a favorable decision regarding alimony issues. There are too many concepts and not enough actual laws for it to be any different. If you have a lot at risk in your divorce matter, alimony is more than likely just one of your concerns. It’s always best to retain legal counsel commensurate with what you have at stake whether that is alimony, property distributions, or child custody disputes.

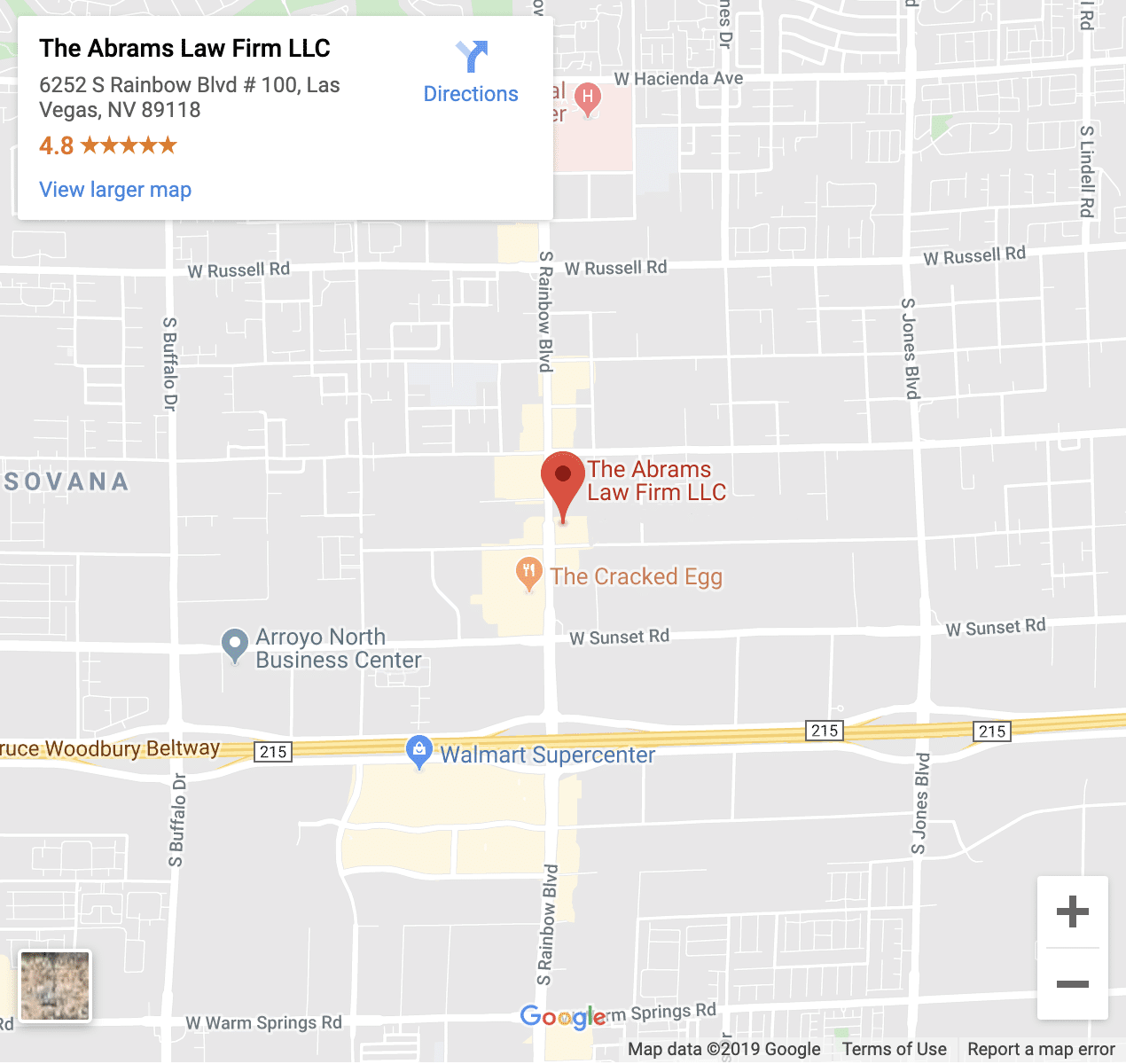

Las Vegas Divorce Attorneys for You

Our Las Vegas divorce attorneys have extensive experience in complex divorce matters including those that relate to alimony claims. Call our office at 702-222-4021 to speak with one of them to schedule a consultation.

Bill Gates, the world’s fourth-richest person, and his wife, Melinda, recently announced that they are getting a divorce after nearly 30 years of marriage. They have an estimated combined net worth of $144 billion. The divorce was filed in King County Superior Court in Seattle, Washington. The divorce has captured public attention and has raised a number of questions in the divorce legal field. Read on for a discussion by our

Bill Gates, the world’s fourth-richest person, and his wife, Melinda, recently announced that they are getting a divorce after nearly 30 years of marriage. They have an estimated combined net worth of $144 billion. The divorce was filed in King County Superior Court in Seattle, Washington. The divorce has captured public attention and has raised a number of questions in the divorce legal field. Read on for a discussion by our

Not all assets in a divorce are as simple to divide as a bank account or a house. Some assets require complex valuation and additional legal hurdles in order to be properly distributed in divorce proceedings. Pensions and other retirement accounts raise a number of valuation issues, tax concerns, and legal technicalities. Divorcing spouses with a pension plan need the guidance of experienced

Not all assets in a divorce are as simple to divide as a bank account or a house. Some assets require complex valuation and additional legal hurdles in order to be properly distributed in divorce proceedings. Pensions and other retirement accounts raise a number of valuation issues, tax concerns, and legal technicalities. Divorcing spouses with a pension plan need the guidance of experienced

Nevada law provides for several different types of spousal support. Depending on a number of factors, if one spouse in a divorce proceeding has a higher income than the other, a court may award temporary spousal support during the length of the proceedings. This temporary support is designed to help the lower-income spouse pay for living expenses until the divorce is final. Some people confuse temporary spousal support with alimony. Alimony payments, if any, occur after the divorce proceedings have concluded. An award of temporary spousal support means that a spouse needing support doesn’t have to wait until the divorce is final. Temporary spousal support can also cover fees for your divorce attorney. Continue reading to learn about temporary spousal support and the other types of support available to you. You can also call our experienced

Nevada law provides for several different types of spousal support. Depending on a number of factors, if one spouse in a divorce proceeding has a higher income than the other, a court may award temporary spousal support during the length of the proceedings. This temporary support is designed to help the lower-income spouse pay for living expenses until the divorce is final. Some people confuse temporary spousal support with alimony. Alimony payments, if any, occur after the divorce proceedings have concluded. An award of temporary spousal support means that a spouse needing support doesn’t have to wait until the divorce is final. Temporary spousal support can also cover fees for your divorce attorney. Continue reading to learn about temporary spousal support and the other types of support available to you. You can also call our experienced

There are many factors to consider when evaluating which divorce attorney is the one best suited to represent you. It’s important to recognize that your case and concerns are unique. We also recognize that the level of expertise we provide is not required for every divorce case. Only you can determine what’s best for your case. The following highlights how and why our divorce attorneys in Las Vegas are different.

There are many factors to consider when evaluating which divorce attorney is the one best suited to represent you. It’s important to recognize that your case and concerns are unique. We also recognize that the level of expertise we provide is not required for every divorce case. Only you can determine what’s best for your case. The following highlights how and why our divorce attorneys in Las Vegas are different.

Prenuptial agreements, often called “prenups,” are contracts entered into between parties in anticipation of marriage. Prenups are increasingly common among couples marrying in the 21st Century, and no longer just reserved for the wealthy and the famous. Family courts may, or may not, defer to prenuptial agreements when it comes to dividing marital property and deciding other economic issues in a divorce. If you are stuck with a prenup that leaves you with nothing or less than you deserve, what are your options? We discuss how you can challenge a Las Vegas prenuptial agreement below.

Prenuptial agreements, often called “prenups,” are contracts entered into between parties in anticipation of marriage. Prenups are increasingly common among couples marrying in the 21st Century, and no longer just reserved for the wealthy and the famous. Family courts may, or may not, defer to prenuptial agreements when it comes to dividing marital property and deciding other economic issues in a divorce. If you are stuck with a prenup that leaves you with nothing or less than you deserve, what are your options? We discuss how you can challenge a Las Vegas prenuptial agreement below.

Many clients who are considering the prospect of divorce ask whether it is better to be the one who files, or if it is better to be the party to respond. For divorce cases the answer is clear: There are advantages of filing for divorce first. In legal terminology, the person who files is known as the plaintiff, the respondent is called the defendant. Being the plaintiff in your divorce gives you several key advantages, even if your divorce is likely to be amicable. Below, we discuss several of the benefits of being the party who files the complaint for divorce.

Many clients who are considering the prospect of divorce ask whether it is better to be the one who files, or if it is better to be the party to respond. For divorce cases the answer is clear: There are advantages of filing for divorce first. In legal terminology, the person who files is known as the plaintiff, the respondent is called the defendant. Being the plaintiff in your divorce gives you several key advantages, even if your divorce is likely to be amicable. Below, we discuss several of the benefits of being the party who files the complaint for divorce.

Most business owners invest their savings and countless hours to make their business a success. And with almost half of new businesses failing within five years, there certainly are no guarantees. So when one or both divorcing spouses own a business, the process becomes complicated. Every business owner should know about divorce and business valuators.

Most business owners invest their savings and countless hours to make their business a success. And with almost half of new businesses failing within five years, there certainly are no guarantees. So when one or both divorcing spouses own a business, the process becomes complicated. Every business owner should know about divorce and business valuators.

Divorcing spouses in Nevada have to disclose their financial condition to the court. This includes a full listing of all their assets. This procedure is meant to ensure that all marital assets are disclosed and therefore subject to division during their divorce case. However, there are instances where spouses try to hide assets through unfair means. Our divorce attorneys in Las Vegas provide valuable information about marital finances, including what we do to uncover the hidden assets for your benefit.

Divorcing spouses in Nevada have to disclose their financial condition to the court. This includes a full listing of all their assets. This procedure is meant to ensure that all marital assets are disclosed and therefore subject to division during their divorce case. However, there are instances where spouses try to hide assets through unfair means. Our divorce attorneys in Las Vegas provide valuable information about marital finances, including what we do to uncover the hidden assets for your benefit.

Getting a divorce is a difficult situation for both spouses. It’s more so if the divorce involves a small business. Business owners going through divorce inherently have a complex divorce matter. Therefore, we’ve created this Las Vegas Divorce Guide for Business Owners. Your business may be the largest marital asset. One or both spouses likely worked long and hard to build it. Now it’s time for a new phase and the challenges that go with it. This guide is not a substitute for, nor is it meant to be, direct legal advice. Rather our

Getting a divorce is a difficult situation for both spouses. It’s more so if the divorce involves a small business. Business owners going through divorce inherently have a complex divorce matter. Therefore, we’ve created this Las Vegas Divorce Guide for Business Owners. Your business may be the largest marital asset. One or both spouses likely worked long and hard to build it. Now it’s time for a new phase and the challenges that go with it. This guide is not a substitute for, nor is it meant to be, direct legal advice. Rather our