Exclusively Dedicated to Complicated Divorce Matters

Complex divorce cases are difficult by their nature. The challenges of life changing events and questions about your future are understandable concerns. For more than twenty years, our law firm has focused exclusively on complex divorce, child custody, and marital law cases. Cases where you have considerable at risk and the well-being of you and your children is paramount. Our Las Vegas divorce attorneys‘ legal skills, case strategies, and courtroom advocacy are regarded by the Las Vegas legal community as exceptional. We also understand the importance of providing counsel to your personal concerns during the time when you need it most.

The Abrams and Mayo Law Firm is a boutique divorce law firm that works with only a finite group of clients at one time. Therefore you’re always a priority. We take pride in producing outstanding results and represent husbands or wives with equal vigor. The high-stakes of complicated legal matters is our only focus. This focus, coupled with a proven track record of success, has earned us a wealth of referrals and 5 Star client reviews.

Your selection of an expert divorce attorney is the primary factor in achieving your case goals. There are no shortcuts. No magic wands. Our attorneys put in the hard work necessary and have a personal dedication to your cause. You deserve an attorney who has the skills to achieve your desired results.

Las Vegas Divorce Attorneys Board Certified by the State Bar of Nevada

Named partners Jennifer V. Abrams and Vincent Mayo are, among other legal career achievements, Board Certified by the State Bar of Nevada as Divorce Law Experts. Only a fraction of one percent of all attorneys in Nevada has this distinction.

We represent clients in divorce, child custody, and marital law matters. Our clients often have complicated cases which may include sophisticated financials, business ownership, complex property divisions, alimony claims, prenuptial or post-nuptial agreements and/or contested child custody matters.

Jennifer and Vincent have a well-earned reputation as two of the best marital law attorneys in the Las Vegas valley. They have successfully represented hundreds of clients in favorable negotiated settlements, or when necessary, trial litigation. Their considerable legal expertise, honed by over four decades of dedicated marital law practice, can be used to your benefit.

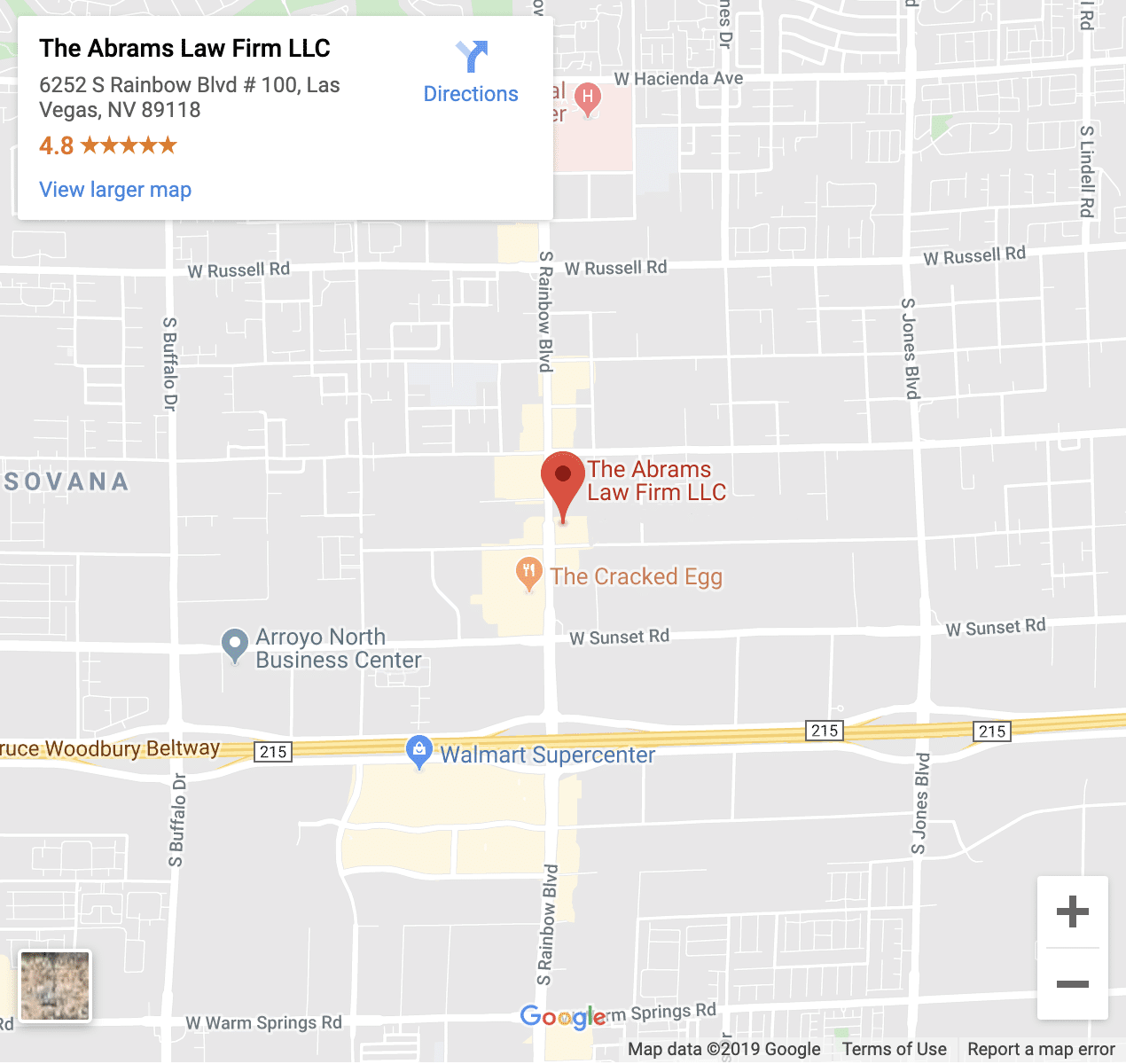

In-Office or Video Conference Consultations

Our Las Vegas divorce attorneys will speak with you directly regarding a consultation. Call our office at 702-222-4021 to speak with one of them and see if what we offer is right for you. We serve clients who reside in Summerlin, Las Vegas, Henderson, North Las Vegas, Spring Valley, and Boulder City. We also serve clients who reside out-of-state or country and have spouses, (or ex-spouses) residing in Clark County, NV. You can choose an in-office or a video conference meeting.